Australia has officially reopened its borders and travel is back on the agenda!

Sipping cocktails on the beach in Fiji? Perhaps snowboarding and skiing in North America, or seeing the sights in Europe? With our Qantas Points^ Home Loan, you don’t have to choose between buying a home and travelling the world.

That’s because when you take out a Qantas Points Home Loan with Qudos Bank you'll earn points from the day you settle.

Where could you go?

Qantas Points can take you across the world using Classic Flight Rewards on eligible flights with Qantas, Jetstar and partner airlines.

Classic Flight Rewards start from as little as 6,400 points on Jetstar and 8,000 points on Qantas one way excluding taxes, fees and carrier charges.

Here are some examples of the exciting and exotic locations your points could take you:

- 83,000 points = business return flight from Sydney to Fiji (plus $278 in taxes, fees and carrier charges)#

- 93,400 points = economy return flights for two people from Melbourne to Singapore (plus $286 in taxes, fees and carrier charges)#

- 110,400 points = economy return flight from Melbourne to London (plus $685 in taxes, fees and carrier charges)#

- 144,000 points = economy return flight for a family of 4 from Sydney to Perth (plus $345 in taxes, fees and carrier charges)#

- 216,800 points = business return flight from Melbourne to Los Angeles (plus $593 in taxes, fees and carrier charges) #

Benefits of the Qantas Points Home Loan

Buying a house here in Australia can be difficult, and many of us have had to sacrifice luxuries like travel after stepping up the property ladder. The Qantas Points Home Loan makes it easier to get out there and enjoy yourself, without adding significant cost to already strained budgets.

The Qantas Points Home Loan has many benefits, including:

- Complimentary Qantas Frequent Flyer membership^

- Bonus 0.10% p.a. interest on selected term deposit accounts*

- $0 bank fees for established homes

- Free multiple offset accounts

- Free unlimited extra repayments

Best of all, you’ll earn 150 Qantas Points each year for every $1,000 of your loan balance, credited monthly. And you’ll earn this for the life of your loan!

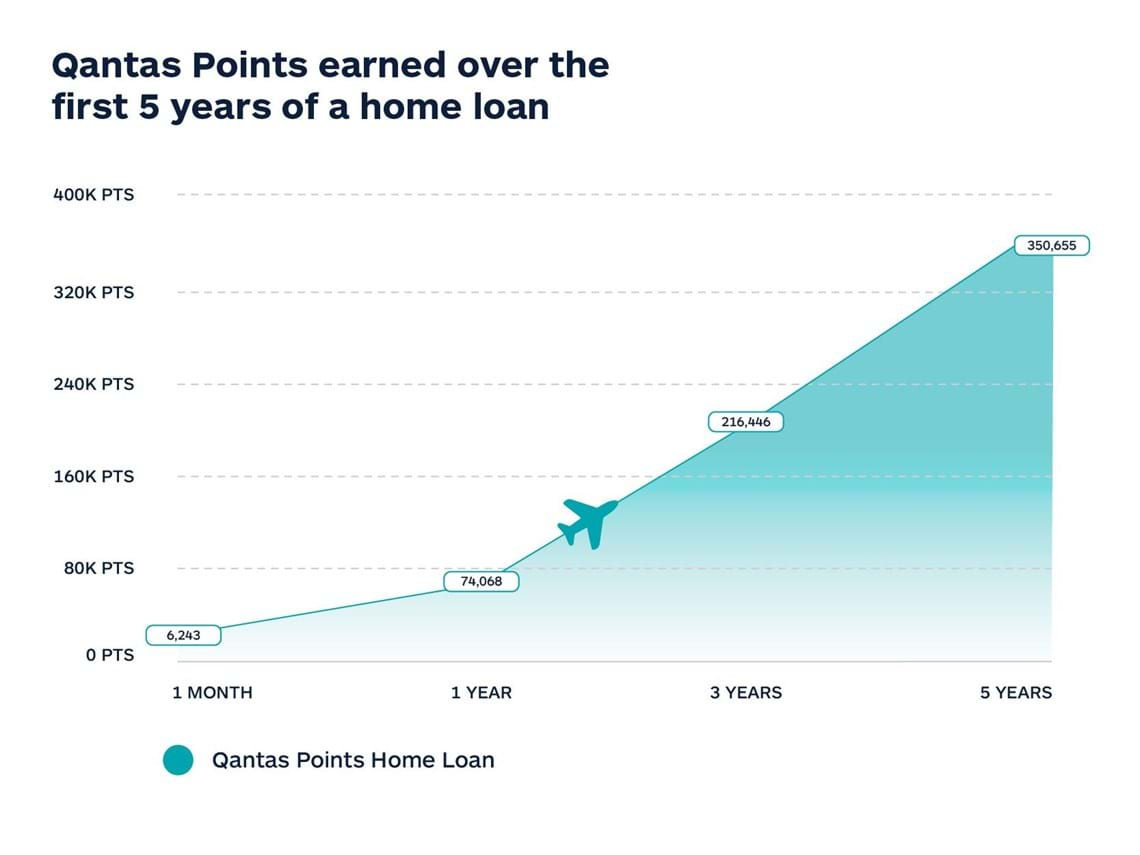

So, for an average loan of $500,000, that's owner-occupied with P&I monthly repayments over 25 years and an 80% LVR, you could earn 350,000 Qantas Points over the first five years of your home loan!^^

This graph shows how many Qantas Points may be earned on a $500,000 variable rate owner-occupied Qantas Points Home Loan with an LVR of 80% and repaid over 25 years, assuming the borrower makes only the scheduled monthly principal and interest repayments. Based on rates at 21/07/2022. Rates subject to change (which will affect points earned).

To find out how much you could earn, pop your loan amount into our Qantas Points Calculator.

Are you keen to start travelling and enjoying your new found freedom?

Apply online for our Qantas Points Home Loan today and start flying sooner!

Qudos Mutual Limited trading as Qudos Bank ABN 53 087 650 557 AFSL/Australian Credit Licence 238 305.

Normal lending criteria, terms and conditions and fees and charges apply. Mortgage insurance is required for home loans over 80% and is subject to approval.

^Qantas Points accrue in accordance with and subject to the Qantas Points Banking Terms and Conditions. You must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. A joining fee may apply, however, Qudos Bank has arranged to provide Qantas Frequent Flyer membership with the joining fee waived to Qudos Bank members who are not already a Qantas Frequent Flyer member and who apply at qantas.com/joinffqudos. Membership and the earning and redemption of Qantas Points are subject to the terms and conditions of the Qantas Frequent Flyer program available online at qantas.com/terms. This offer is non transferable and not available in conjunction with any other offer. Qantas Frequent Flyer membership and each application is subject to approval by Qantas. Qudos Bank recommends that you seek independent tax advice in respect of the tax consequences (including fringe benefits tax, and goods and services tax and income tax) arising from the use of this product or from participating in the Qantas Frequent Flyer program or from using any of the rewards or other available program facilities. Qudos Bank is the issuer, offeror and administrator of the Qudos Bank Qantas Points Banking products and is a credit provider and credit licensee under National Consumer Credit laws.

^^Excludes existing loans, switching and variations. Lending criteria, fees, T&Cs apply. These offers can be withdrawn by Qudos Bank at any time.

#Qantas Points and taxes, fees and carrier charges quoted for Classic Flight Rewards are accurate as at 20 January 2022 and are subject to change. Classic Flight Rewards are subject to capacity controls, availability is limited, and some flights may not have any Classic Flight Rewards available. Taxes, fees and carrier charges are payable to Qantas (excluding any amounts payable to third parties at the airport) in addition to the points required. For more information, visit qantas.com/classicflightrewards.

*Rate applies to term deposits account opened during the term of your Qantas Points Home Loan. Special terms of 3, 6, 9 and 12 months are available and are upon request.

The information in this article is of a general nature and has been prepared without considering your objectives, financial situation or needs. Before acting on the information, consider its appropriateness to your circumstances.

Before opening an account with us, you should read, as relevant, our Credit Card Terms and Conditions, Terms and Conditions for Savings Accounts and Payment Services, Qantas Points Banking Rewards Terms and Conditions and Financial Services Guide.

Published March 2022

Updated June 2022

Updated August 2022

Updated December 2022